Which digital wallet app is best for you? Compare top Android options, explore features, pros, cons, and find the perfect fit for your needs.

In 2024, the global market for mobile wallet transactions is set to exceed $8.19 billion, underscoring the rapid growth and adoption of virtual payment systems.

These digital wallets enable users to securely store payment information, conduct transactions, and manage their finances directly from their smartphones.

With just a few taps, you can pay for groceries, shop online, or send money to a friend without needing cash or physical cards. As more people adopt these apps, the market for digital wallets continues to grow, offering various options tailored to specific needs.

In this post, I will help you choose the best digital wallet for your financial needs by comparing features, ease of use, and the pros and cons of popular digital wallet apps.

What is a Digital Wallet App?

A digital wallet app, also known as an e-wallet or mobile wallet, is software designed to securely store payment information and manage financial transactions from a smartphone.

The primary purpose of these apps is to simplify and enhance the way you handle your money. It offers a convenient alternative to carrying physical cash or cards.

How Digital Wallet Apps Work

Digital wallet apps work by securely storing your payment information, such as credit card details, debit card numbers, and bank account information, on your smartphone.

When you make a purchase, either online or in-person, the app uses this stored information to complete the transaction. Here’s a brief overview of how they operate:

- Storing Payment Information: Once you add your credit or debit card details to the app, it encrypts and securely stores this information. Some apps also allow you to store digital versions of loyalty cards and coupons.

- Making Transactions: When you make a payment, you can either use a QR code, NFC (Near Field Communication), or a secure payment link. For in-person transactions, you typically tap your phone on a contactless payment terminal. For online purchases, you select the digital wallet at checkout and authenticate the payment.

- Security Features: Digital wallets often come with advanced security features such as biometric authentication (fingerprint or facial recognition), tokenization (replacing card details with a unique identifier), and encryption to protect your financial information from unauthorized access.

Where and How to Download Digital Wallets for Android

To get started with a digital wallet app on your Android device, you can download it from the following sources:

- Google Play Store: The most common and straightforward way to find and install digital wallet apps is through the Google Play Store. Simply open the Google Play Store on your device, search for the name of the digital wallet app you’re interested in, and tap “Install.”

- Direct App Websites: Some digital wallet apps are available for download directly from their official websites. Visit the website of the digital wallet provider, find the download link for the Android version, and follow the instructions to download and install the app.

Step-by-Step Guide to Downloading and Installing a Digital Wallet on Android

- Open the Google Play Store: Locate and tap on the Google Play Store icon on your Android device’s home screen or app drawer.

- Search for the Digital Wallet App: Tap on the search bar at the top of the screen and type in the name of the digital wallet app you want to download (e.g., Google Wallet, Cash App, PayPal).

- Select the App: Find the app you want from the search results and tap on it to open its detail page.

- Tap “Install”: On the app’s detail page, tap the “Install” button to begin downloading and installing.

- Open the App: Once the installation is complete, tap “Open” to launch the app. Alternatively, you can find the app icon on your home screen or app drawer and tap on it to open.

- Set Up Your Account: Follow the on-screen instructions to set up your account. This typically involves entering your payment information, verifying your identity, and setting up any security features such as a PIN or biometric authentication.

- Start Using Your Digital Wallet: After setup, you can start using your digital wallet to make transactions, store payment methods, and manage your finances.

Types of Digital Wallets

Digital wallets come in various types, each designed to meet different needs and preferences. The main categories are open wallets, closed wallets, and semi-closed wallets. Here’s a detailed look at each type:

Open Wallets

Open wallets are digital wallet apps that allow users to make payments at a wide range of merchants and service providers. These wallets are often linked to traditional bank accounts or credit cards and can be used for both online and offline transactions.

Examples:

- Google Wallet: Allows users to make payments at any merchant that accepts contactless payments and can be linked to multiple bank accounts or credit cards.

- PayPal: Provides a broad payment platform for online transactions and can be used for purchases at various online retailers and service providers.

Features:

- Broad acceptance across various merchants and online platforms.

- Often linked to multiple payment sources (e.g., bank accounts, credit cards).

- Allows users to send money to other users and make purchases online.

Closed Wallets

Closed wallets are digital wallet apps issued by specific retailers or companies, which can only be used for transactions within their ecosystem. These wallets are generally restricted to the issuing company's stores or services.

Examples:

- Amazon Pay: Used primarily for purchases on Amazon and at partner merchants who accept Amazon Pay.

- Starbucks Card: Allows users to pay for purchases only at Starbucks locations or through their app.

Features:

- Limited to transactions within a specific network or retail chain.

- Often include loyalty programs, rewards, or discounts exclusive to the issuing company.

- Useful for frequent shoppers at the issuing retailer.

Semi-Closed Wallets

Semi-closed wallets are digital wallets that can be used for transactions at a range of merchants but are not as universally accepted as open wallets. Financial institutions or payment networks often issue them and can be used at specific locations or within a defined ecosystem.

Examples:

- Cash App: Allows users to make purchases at various locations and transfer money to other users but has certain restrictions compared to open wallets.

- Samsung Wallet: This can be used at various merchants that accept contactless payments, but its features may be optimized for Samsung device users.

Features:

- Usable at a select group of merchants or within specific networks.

- May offer additional features such as loyalty programs, integrated services, or unique benefits tied to the issuing entity.

- Provides more flexibility than closed wallets but less than open wallets.

Top Digital Wallet Apps for Android Devices

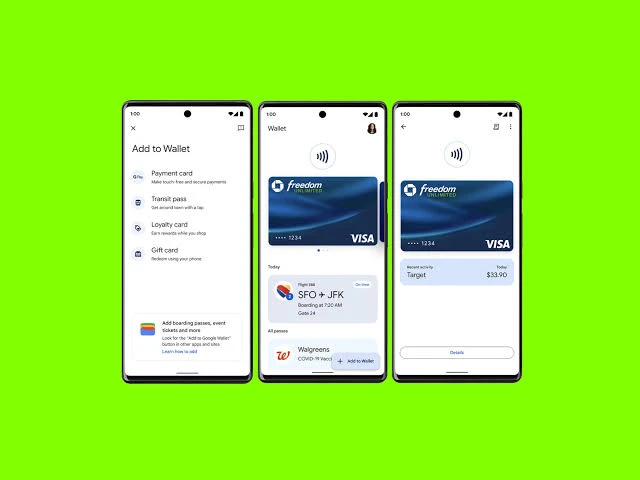

1. Google Wallet

Google Wallet is a widely used digital wallet app developed by Google. It enables users to make payments, store loyalty cards, and manage their transactions from their Android devices. It integrates seamlessly with Google services and offers a range of features designed to enhance convenience and security.

Key Features

- Tap-to-Pay: Allows for contactless payments using NFC technology at participating merchants.

- Security: Utilizes advanced security measures such as encryption, biometric authentication, and tokenization.

- Rewards and Offers: Provides access to special deals, offers, and loyalty programs linked to participating merchants.

Pros

- Broad acceptance at various merchants and online platforms.

- High security with robust encryption and authentication.

- Integration with other Google services, enhancing user convenience.

Cons

- Limited support in some countries.

- May require additional setup for linking bank accounts or cards.

Usage Statistics

Google Wallet has over 48.59 million of users worldwide and is available in numerous countries. It enjoys widespread adoption due to its integration with Google's ecosystem and user-friendly features.

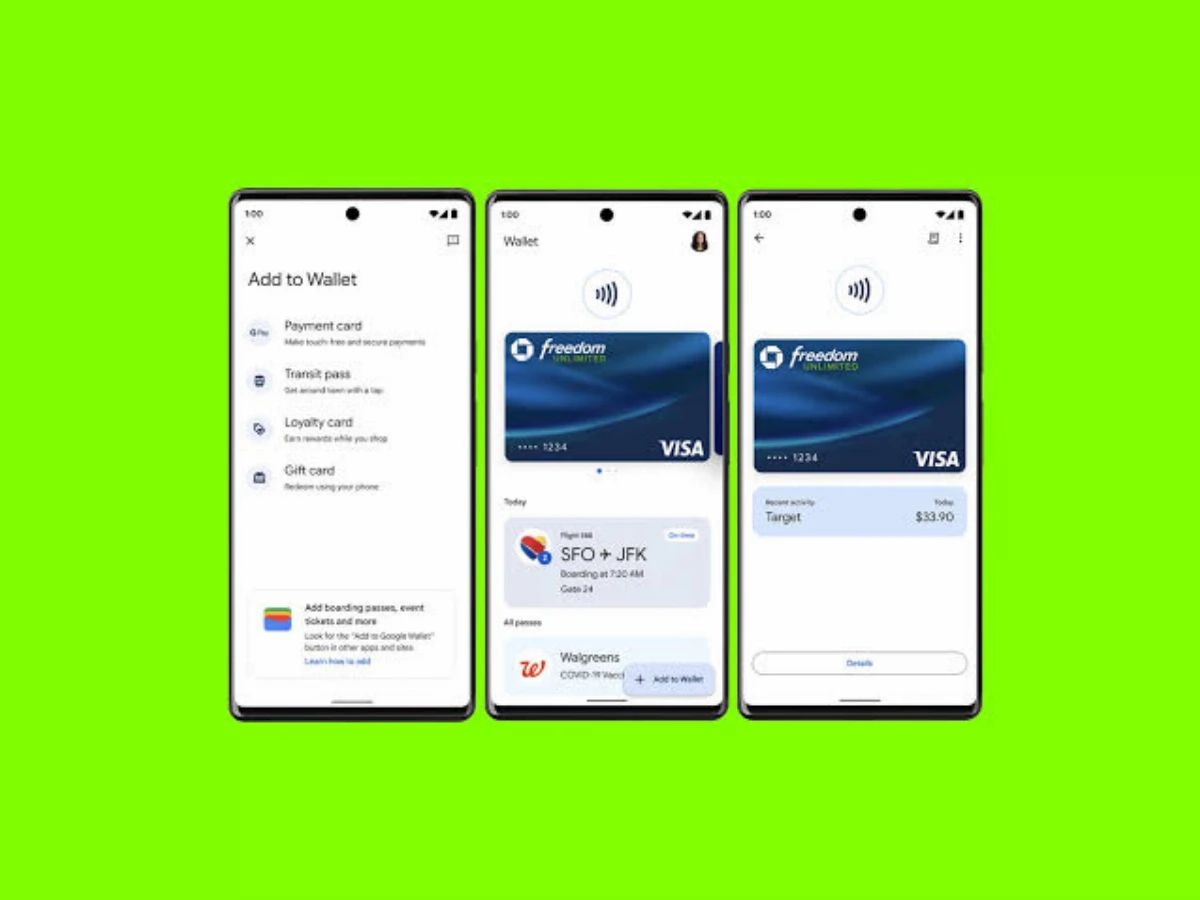

2. Cash App

Cash App, developed by Block, Inc. is a versatile digital wallet app that allows users to send and receive money, make purchases, and invest in stocks and Bitcoin. It offers a wide range of financial services beyond basic payments.

Key Features

- Peer-to-Peer Payments: Facilitates quick and easy transfers between users.

- Stock Trading: Enables users to buy and sell stocks directly from the app.

- Bitcoin Integration: Allows users to buy, sell, and hold Bitcoin.

Pros

- Versatile features including financial investments.

- Easy-to-use interface for sending and receiving money.

- No fees for basic transactions.

Cons

- Limited availability in some countries.

- Fees apply for instant transfers and certain transactions.

Usage Statistics

Cash App has over 50 million active users in the U.S. and the U.K. It continues to grow rapidly due to its comprehensive suite of financial services.

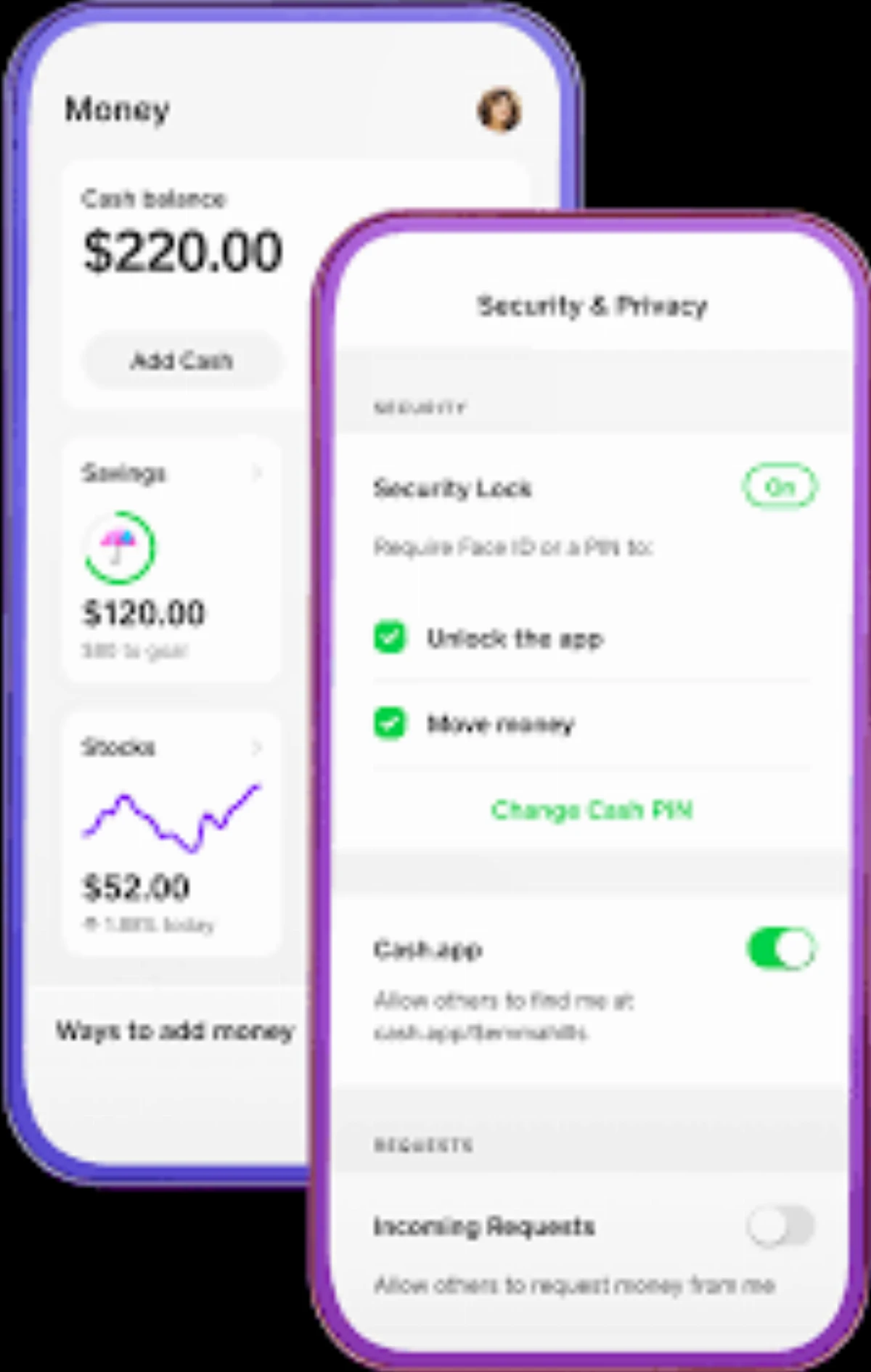

3. Samsung Wallet

Samsung Wallet is a digital wallet app exclusive to Samsung device users. It provides a secure and convenient way to make payments, store cards, and manage transactions directly from Samsung smartphones.

Key Features

- Integration with Samsung Devices: Optimized for use with Samsung smartphones and wearables.

- Biometrics: Uses fingerprint and facial recognition for secure access.

- Contactless Payments: Supports NFC-based payments at participating merchants.

Pros

- Seamless integration with Samsung hardware.

- High security with advanced biometric authentication.

- Exclusive features tailored for Samsung users.

Cons

- Limited to Samsung device users.

- Less widely accepted compared to more universal digital wallets.

Usage Statistics

Samsung Wallet is particularly popular among Samsung device users, especially within the 25-34 age group, which makes up 62.1% of Samsung Pay users in the United Kingdom. This reflects a growing user base as Samsung continues to expand its presence in the smartphone market.

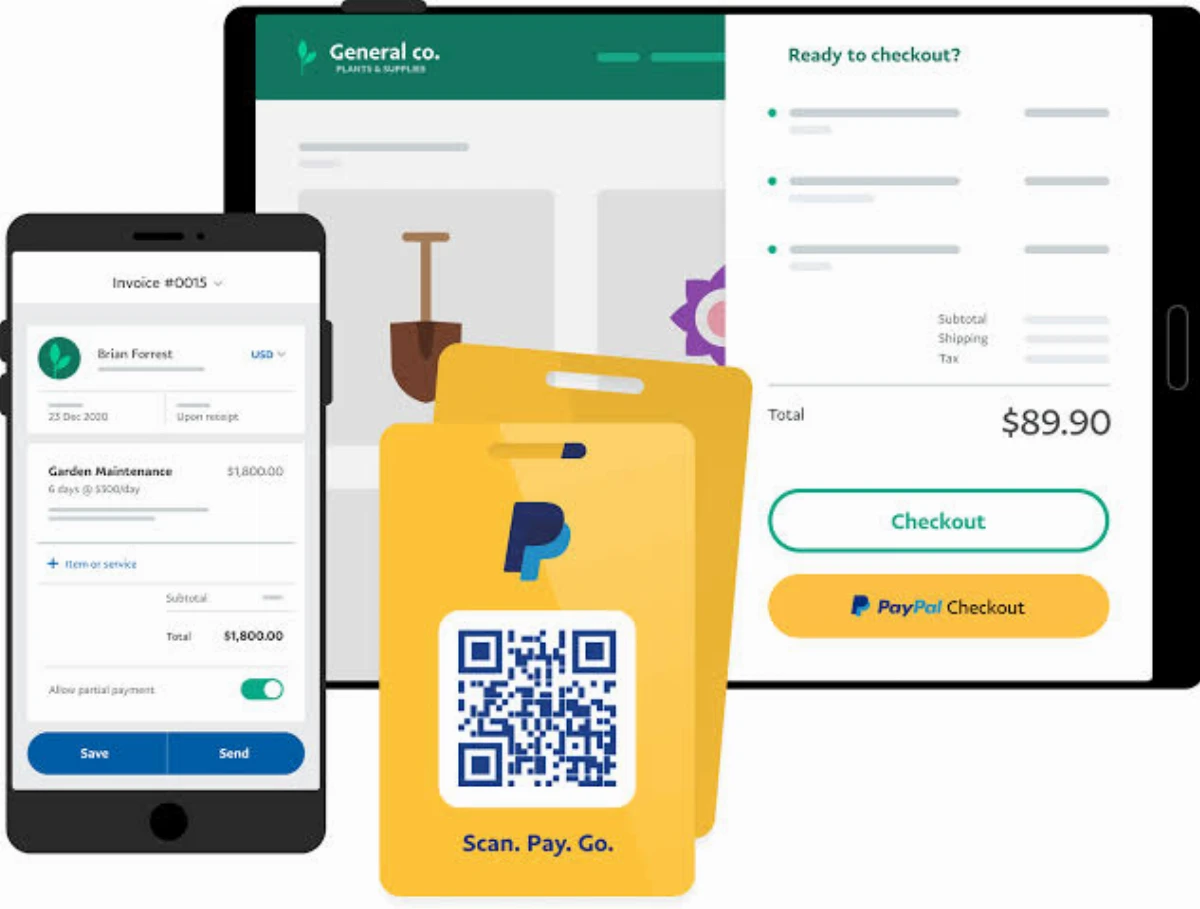

4. PayPal

PayPal is a well-established digital wallet and payment platform that enables users to make online transactions, send money, and manage their finances. It is one of the most widely recognized and trusted digital wallets globally.

Key Features

- International Payments: Supports transactions in multiple currencies across borders.

- Security: Offers strong encryption and fraud protection.

- Multiple Currency Options: Allows users to hold and transact in various currencies.

Pros

- Wide acceptance at online retailers and service providers.

- Strong security features and buyer protection.

- Convenient for international transactions.

Cons

- Fees may apply for certain types of transactions, including currency conversions.

- Customer service can be inconsistent.

Usage Statistics

PayPal has over 400 million active accounts worldwide. Its extensive reach and reliability make it a popular choice for online and international payments.

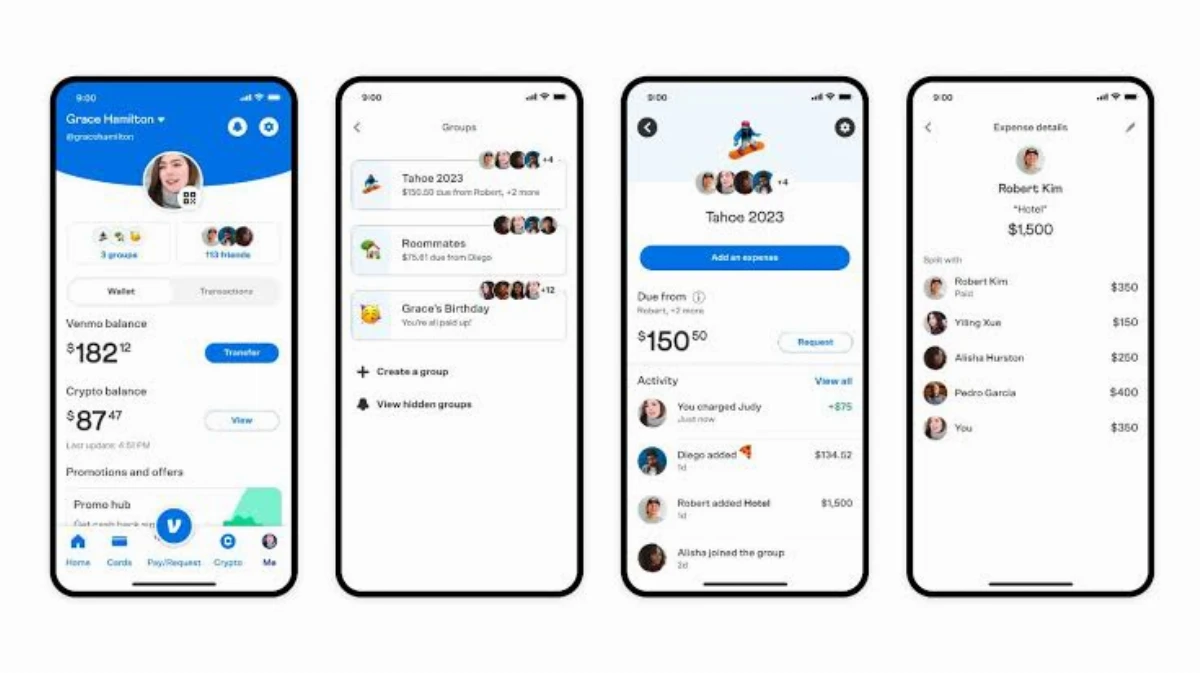

5. Venmo

Venmo, owned by PayPal, is a popular digital wallet app that focuses on peer-to-peer payments and social transactions. It allows users to send and receive money easily while sharing transactions with friends.

Key Features

- Social Payments: Users can include notes and emojis with payments, sharing transaction details on a social feed.

- Peer-to-Peer Transfers: Simplifies sending and receiving money between users.

- Link to Bank Accounts: Easily connects with bank accounts for seamless transactions.

Pros

- User-friendly interface with social features.

- Free to send money using a linked bank account or debit card.

- Quick transfers between Venmo users.

Cons

- Limited to the U.S.

- Fees apply for instant transfers and credit card payments.

Usage Statistics

Venmo has over 68.3million users in the U.S as at 2024, projected to be 80.2million by 2027. Its popularity continues to grow, especially among younger demographics who appreciate its social payment features.

Conclusion

The surge in mobile wallet transactions is expected to exceed $9.41 billion by 2025. Digital tools are simplifying payments and enhancing security and convenience in ways that traditional cash and cards can't match.

When choosing the right digital wallet, consider your financial habits and preferences. Evaluate factors such as fees, user experience, compatibility with stores and services, and the specific features each wallet offers.

Ready to get started? Download one of the recommended digital wallets today and experience the convenience and security of modern financial management.