Choosing the right bank and financial institution has a lot to say about your personal finances and company finances too. Here is what you should know.

What are financial institutions?

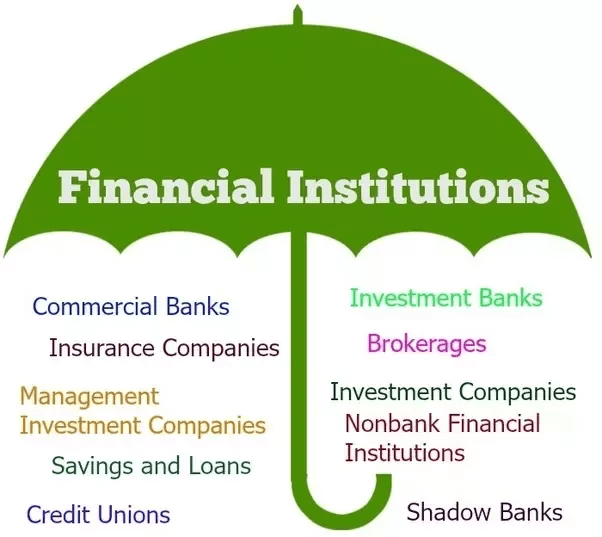

Financial institutions are organizations that provide various financial services to individuals, businesses, and governments. These institutions play a crucial role in facilitating the flow of funds in the economy and also offer ranges of financial products and services.

TYPES OF FINANCIAL INSTITUTIONS

Here are some common types of financial institutions:

- Banks: Banks are the most well-known and traditional financial institutions. They accept customer deposits and provide services such as checking accounts, savings accounts, loans, mortgages, credit cards, and investment products. Banks also facilitate payments, wire transfers, and currency exchange services.

- Credit Unions: Credit unions are usually member-owned financial cooperatives that offer similar services to banks. However, they are typically smaller in scale and operate not for profit. Credit unions serve specific communities or groups and often provide better interest rates on loans and more interest rates on savings accounts compared to traditional banks.

- Insurance Companies: Insurance companies provide protection against potential financial risks. They offer various types of insurance policies, including life insurance, health insurance, property and death insurance, and auto insurance. Insurance companies collect premiums from policyholders and provide financial compensation in the event of covered losses or risks.

- Investment Firms: Investment firms, including brokerage firms and asset management companies, assist individuals and organizations in investing their money. They offer services like buying and selling stocks, bonds, and other securities, providing investment advice, managing investment portfolios, and offering retirement planning services.

- Pension Funds: Pension funds are known as financial institutions that help manage retirement savings on behalf of employees. These funds are typically sponsored by employers or governments and invest in the contributions made by employees during their working years. Pension funds aim to provide income or pension benefits to retirees.

- Mutual Funds: Mutual funds get money from several smart investors to invest in a diversified portfolio of securities, such as bonds and money market materials. Professional investment managers manage them and offer individuals the chance to invest in a diversity of assets with relatively lower investment amounts.

- Hedge Funds: Hedge funds are actually private investment funds that cater to wealthy individuals and institutional investors. They employ various investment strategies to generate high returns, including leveraging, short-selling, and derivatives trading. Hedge funds often have fewer regulatory restrictions compared to mutual funds but carry higher risks.

- Non-Banking Financial Companies (NBFCs): NBFCs are financial institutions that provide banking-like services but are not full-fledged banks. They offer services such as loans, leasing, credit facilities, and investment products. NBFCs often specialize in serving specific sectors or catering to underserved markets.

Also read: The Importance Of Protecting Your Assets With Insurance

These are just a few examples of financial institutions. The financial industry is vast and diverse, encompassing a wide range of organizations that provide specialized financial services to meet the intent of individuals, businesses, and governments.

The Importance of Choosing the Right Bank and Financial Institution

Choosing the right bank and financial institution is an essential decision that can significantly impact your financial well-being. Here are several reasons why selecting the right bank is important:

- Safety and Security: One of the primary concerns when choosing a bank is the safety and security of your funds. Opting for a reputable financial institution regulated and supervised by relevant authorities is crucial. Look for banks that offer deposit insurance or guarantees, such as the Federal Deposit Insurance Corporation (FDIC) in the United States, which protects deposits up to a certain amount per depositor. This ensures that your money is protected in case of bank failures or other unforeseen events.

- Services and Products: Different banks offer a wide range of services and products, and choosing the right one can provide you with convenient and tailored solutions to meet your financial needs. Consider the types of accounts they offer, such as checking, savings, and investment accounts, as well as additional services like loans, credit cards, and online banking. Assess whether the bank provides the tools and technologies that align with your preferences and enable efficient management of your finances.

- Fees and Charges: Banks often charge fees for various services, such as account maintenance, ATM withdrawals, wire transfers, and overdrafts. Reviewing the fee structure and comparing it with other banks is essential to finding an institution that offers fair and transparent fee policies. Look for banks that provide fee waivers, discounts, or account options that suit your financial situation and usage patterns.

- Interest Rates and Returns: Interest rates and potential returns become critical factors if you plan to save or invest your money. Compare the interest rates different banks offer for savings platforms, certificates of deposit (CDs), and other financing packages. Consider whether the bank provides competitive rates to help your savings grow.

- Customer Service and Support: A bank's quality of customer service can significantly impact your banking experience. Look for banks that offer reliable and accessible customer support platforms, such as phone, email, and online chat. Consider reading customer reviews and assessing the bank's reputation for responsiveness, problem resolution, and overall customer satisfaction.

- Accessibility and Convenience: Evaluate the accessibility and convenience factors that matter to you. Consider the bank's branch and ATM network, especially if you prefer in-person banking services. If you prioritize digital banking, assess the bank's online and mobile banking platforms, ensuring they provide user-friendly interfaces, robust security measures, and convenient features like mobile check deposits and bill payments.

- Specialized Services: Depending on your financial goals and requirements, you may need technical services from your bank. For example, if you are a business owner, look for a bank that offers business banking solutions, merchant services, or business loans. Similarly, if you frequently engage in international transactions, consider banks that provide foreign currency services or have partnerships with international banks.

Also read: How To Manage Your Money As A Freelancer Or Enterpreneur

Choosing the right bank and financial institution is not a one-size-fits-all decision. It depends on your individual financial situation, preferences, and long-term goals. Take the time to research and compare options, considering the factors mentioned above. Prioritize finding a bank that aligns with your needs, provides security, offers competitive services, and supports your financial journey effectively.