Tax Deduction for small businesses allows you to reinvest back into your business. Learn how to reduce taxable income, lower tax liability, and maximize savings.

Running a small business can be a rewarding but challenging endeavor and managing taxes is often one of the most complicated aspects.

Fortunately, tax deductions are a way to reduce your tax burden, allowing you to reinvest those savings back into your business.

In this guide, I will walk you through 15 essential tax deductions for small businesses in 2024, helping you make the most of these opportunities while staying compliant with tax regulations.

Key Takeaway

- Tax deductions for small businesses help reduce taxable income and lower overall tax liability.

- Common deductions include home office expenses, business meals, vehicle expenses, etc.

- Businesses should avoid trying to deduct personal expenses.

- Small businesses should maintain detailed records, use tax management tools and seek advice from tax professionals.

What is Tax Deduction?

A tax deduction is an expense that you can subtract from your taxable income, reducing the amount of income on which you are taxed. This can lower your overall tax liability, meaning you might owe less in taxes or receive a larger refund.

Tax deduction for a small business

Tax deductions for a small business are expenses that the business can subtract from its total income to reduce the taxable income, which ultimately lowers the amount of tax the business owes.

These deductions are intended to cover the costs of running and maintaining the business and can vary widely depending on the nature of the business.

Impact of Tax Deductions on Small Businesses

Tax deductions play a critical role in the financial management of small businesses, offering both benefits and challenges. Below are some of the key ways tax deductions influence small businesses:

Positive Impacts

- Reduced Tax Liability: Deductions decrease a business's overall tax burden by lowering taxable income. This reduction can lead to significant savings, allowing businesses to reinvest funds into operations or growth initiatives.

- Improved Cash Flow: Businesses experience improved cash flow due to reduced tax payments. The additional liquidity can be used to expand operations, hire new employees, or invest in new equipment, directly contributing to growth.

- Incentivized Business Investments: Deductions for equipment purchases and research and development (R&D) encourage businesses to invest in innovation. This not only boosts productivity but also enhances long-term competitiveness.

- Increased Profitability: Minimizing tax obligations through deductions can improve profitability, making the business more sustainable and attractive to potential investors.

- Support for Regulatory Compliance: Deductions for compliance-related expenses, such as accounting or legal fees, help businesses stay current with regulations, reducing the risk of penalties and ensuring smooth operations.

Negative Impacts

- Complexity and Compliance Costs: The rules surrounding tax deductions can be complicated, especially with changing tax laws. Businesses must hire accountants or tax professionals to navigate this complexity, increasing operational costs.

- Higher Audit Risk: Claiming multiple or large deductions can raise the risk of being audited. Audits are stressful and can result in penalties if deductions aren’t properly documented or justified.

- Delayed Cash Flow Benefits: Some deductions, like depreciation, are spread over several years, delaying immediate financial benefits. This requires careful cash flow management to cover business expenses in the short term.

- Overdependence on Deductions: Relying too heavily on deductions to maintain profitability can be risky, especially if tax laws change. Businesses may face financial difficulties if key deductions are reduced or eliminated.

- Risk of Underestimating Taxes: Miscalculating deductions or over-relying on them can lead to underpayment of taxes, resulting in unexpected liabilities or penalties during tax season.

15 Types of Tax Deductions for Small Businesses

Here are 15 types of tax deductions that small businesses can typically claim to reduce their taxable income:

1. Home Office Deduction

If you use part of your home exclusively for business, you may be able to deduct expenses related to that space, such as mortgage interest, rent, utilities, and home maintenance.

2. Business Meals

You can deduct 50% of the cost of business-related meals with clients, employees, or for travel purposes, as long as the expenses are not lavish and are directly related to the business.

3. Travel Expenses

Deduct expenses for business-related travel, including airfare, lodging, car rentals, and other transportation costs, as well as meals and incidental expenses while traveling.

4. Vehicle Expenses

You can deduct vehicle expenses if you use your car for business purposes. Deductions can be based on the standard mileage rate or actual expenses like gas, maintenance, and insurance.

5. Salaries and Wages

Wages paid to employees, including salaries, bonuses, and other forms of compensation, are deductible business expenses.

6. Rent or Lease Payments

If you rent or lease office space, equipment, or vehicles, you can deduct these costs as business expenses.

7. Supplies and Equipment

Deduct the cost of office supplies, tools, and equipment used in your business. For significant equipment purchases, you may be able to use the Section 179 deduction to deduct the full cost in the year of purchase.

8. Utilities

Deduct expenses for utilities used in your business, such as electricity, water, heat, and phone and internet service.

9. Insurance

Premiums for business insurance policies, such as liability insurance, property insurance, and workers' compensation, are deductible.

10. Professional Services

Fees paid to lawyers, accountants, consultants, and other professionals who provide services directly related to your business are deductible.

11. Marketing and Advertising

Costs for marketing and advertising, including digital ads, print ads, social media promotions, and business cards, can be deducted.

12. Interest on Business Loans

Interest paid on business loans or credit lines used for business purposes is deductible, including loans for equipment or real estate.

13. Education and Training

Deduct expenses for courses, workshops, or other training that improves skills relevant to your business or industry.

14. Depreciation

Depreciation allows you to deduct the cost of business assets, like equipment, buildings, and vehicles, over their useful life rather than all at once.

15. Employee Benefits

Deduct costs for employee benefits, such as health insurance, retirement plan contributions, and other employee welfare programs.

Small businesses taking advantage of these deductions can lower their taxable income, reducing their tax liability.

Business Expenses You Can't Deduct Tax

Many business expenses are tax-deductible. However, there are certain expenses that you cannot deduct. Here are some common business expenses that typically do not qualify for tax deductions:

1. Personal Expenses

Expenses that are personal in nature, not directly related to the business, cannot be deducted. This includes personal travel, clothing, or entertainment costs not related to business activities.

2. Political Contributions

Donations to political campaigns, parties, or political action committees (PACs) are not deductible, even if the business is attempting to support favorable policies.

3. Lobbying Expenses

Costs associated with lobbying or attempting to influence legislation are generally not deductible. This includes expenses for professional lobbyists or costs related to advocating for changes in the law.

4. Fines and Penalties

Fines, penalties, or fees paid to the government for breaking the law, such as traffic tickets, OSHA fines, or late filing fees, are not deductible.

5. Commuting Costs

The cost of commuting from your home to your regular place of business is considered a personal expense and is not deductible, even if you use a personal vehicle.

6. Entertainment Expenses

While meals with clients may be partially deductible, most entertainment expenses, such as tickets to concerts, sports events, or other entertainment activities, are generally not deductible.

7. Club Dues and Memberships

Membership fees for clubs organized for business, pleasure, recreation, or social purposes (like country clubs, athletic clubs, or dining clubs) are not deductible.

8. Capital Expenses

While capital expenses (such as the purchase of land, buildings, or major equipment) are not immediately deductible, they may be eligible for depreciation or amortization over time rather than an immediate deduction.

9. Gifts Over a Certain Limit

Business gifts to clients or customers are only partially deductible. The IRS generally limits the deduction to $25 per person per year, regardless of the cost of the gift.

10. Illegal Activities

Any expenses related to illegal activities, such as bribes or kickbacks, are not deductible. This also includes any expenses tied to businesses that are illegal under federal law, even if legal under state law.

11. Life Insurance Premiums

Premiums paid for life insurance policies where the business or its owner is the beneficiary are generally not deductible.

12. Hobbies

Expenses for activities that the IRS deems as hobbies (not for profit) are not deductible. The IRS scrutinizes deductions for activities that do not generate profit over time.

13. Losses from Selling Property to Related Parties

Losses from the sale or exchange of property between related parties (such as between family members or a business owner and their company) are not deductible.

14. Federal Income Taxes

Federal income taxes paid are not deductible as a business expense, although some state and local taxes related to business activities may be deductible.

15. Charitable Contributions (for certain business types):

While charitable contributions are generally deductible for corporations, they may not be deductible as a business expense for sole proprietors, partnerships, or LLCs, but rather as personal deductions on individual tax returns.

Tools or Apps for Managing Tax Deduction

Here are six of the most highly-rated tools and apps for managing and identifying tax deductions for small businesses:

1. QuickBooks

Alt text: Gif of QuickBooks and how it works.

A leading accounting software popular among small businesses for tracking expenses, managing receipts, and generating reports. QuickBooks integrates with bank accounts and credit cards, automatically categorizing expenses to help identify deductions.

Features

- Invoicing,

- expense tracking,

- Tax deduction identification,

- Integration with other financial tools.

Why It’s Highly Rated

- User-friendly interface,

- Robust features such as invoicing, expense tracking, etc.

- Comprehensive financial management capabilities.

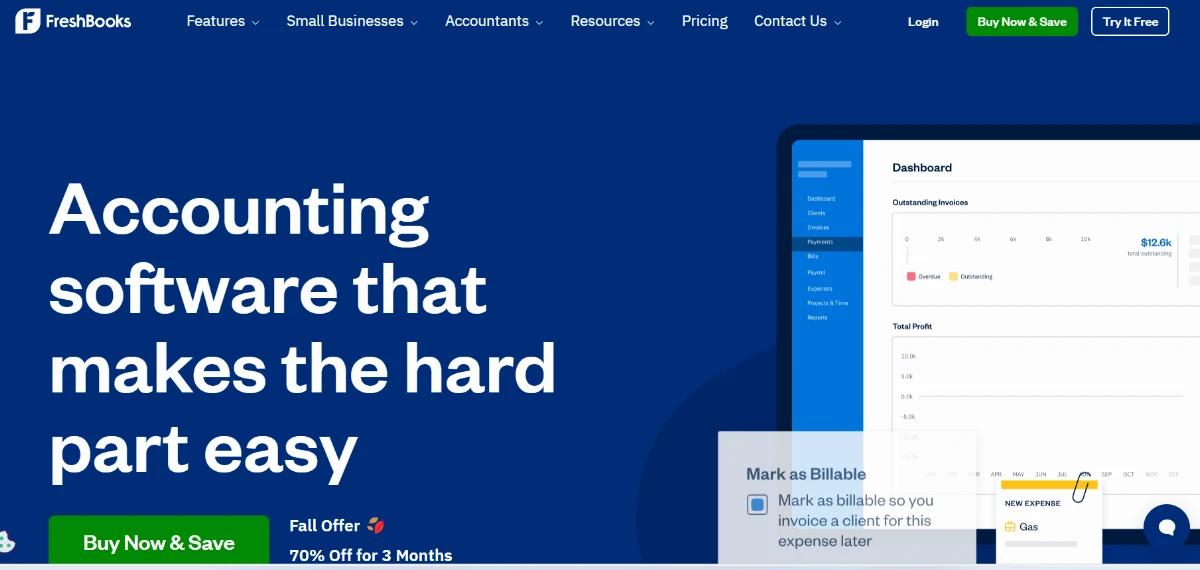

2. FreshBooks

Alt text: FreshBooks app display on a PC, Tab. And Smartphones.

Known for its simplicity and ease of use, FreshBooks helps small businesses manage expenses, track time, and generate invoices. It offers detailed reports that can help identify deductible expenses.

Features

- Automated expense tracking

- Receipt management

- Time tracking

- Customizable invoicing

Why It’s Highly Rated

- Excellent customer support,

- Intuitive design,

- Strong expense tracking capabilities tailored for small businesses.

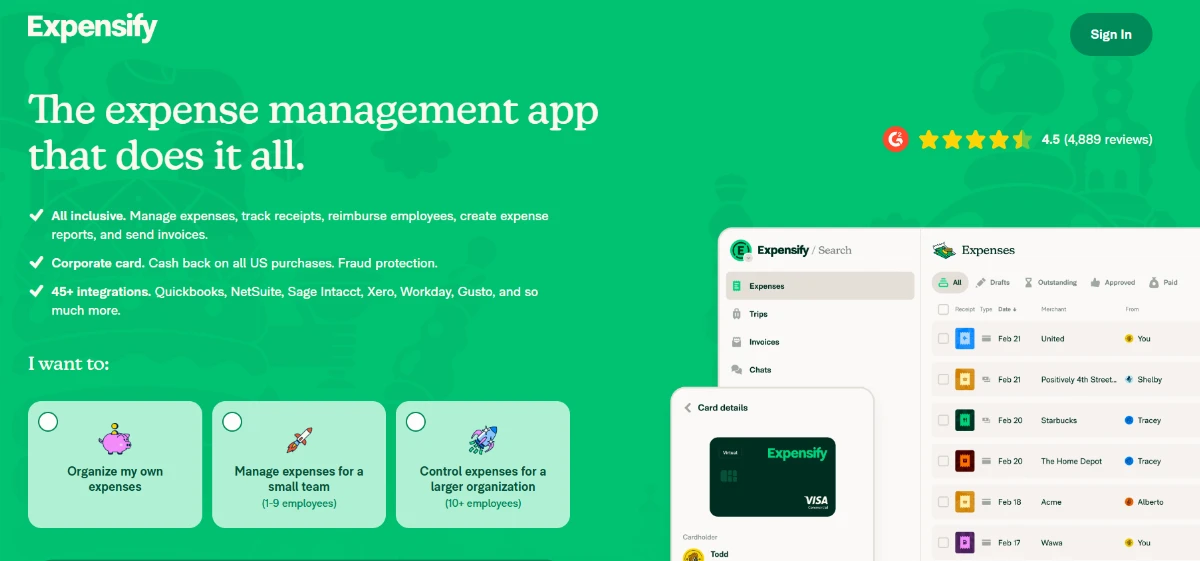

3. Expensify

A popular app for expense management and receipt tracking, Expensify simplifies the process of identifying deductible expenses. It can automatically categorize expenses and integrate well with other accounting platforms.

Features

- Receipt scanning

- Expense categorization

- Mileage tracking

- Real-time expense reporting

Why It’s Highly Rated

- Highly effective for receipt management

- Seamless integration

- Automation of expense tracking

4. Xero

Xero provides comprehensive accounting software for small businesses, including features for tracking expenses, managing invoicing, and reconciling bank transactions. It helps businesses keep accurate records and easily identify deductible expenses.

Features

- Bank reconciliation

- Expense tracking

- Financial reporting

- Integration with third-party apps

Why It’s Highly Rated

- Cloud-based accessibility

- Scalability

- A wide range of features for comprehensive financial management

5. Keeper Tax

Specifically designed for freelancers and small business owners, Keeper Tax automatically scans bank and credit card transactions for tax-deductible expenses. It provides personalized tax advice and helps track potential deductions.

Features

- Automated deduction tracking,

- Tax filing support,

- Personalized tax insights.

Why It’s Highly Rated

- Simplifies tax deduction tracking,

- Great for freelancers and self-employed individuals,

- Offers proactive tax tips.

6. TurboTax Self-Employed

TurboTax Self-Employed is a tax preparation software that helps freelancers and small business owners find deductions specific to their industry. It includes expense tracking and provides guidance on eligible deductions throughout the year.

Features

- Tax preparation,

- Deduction finder,

- Expense tracking,

- Integration with other financial tools.

Why It’s Highly Rated

- Industry-specific deduction identification,

- User-friendly interface,

- Comprehensive tax filing support.

These six tools and apps are highly rated for their ability to streamline expense tracking and maximize tax deductions for small businesses, making tax time less stressful and more efficient.

Read Also:

Final Thoughts

Leveraging the right tools and strategies can help small businesses reduce taxable income, optimize cash flow, and reinvest savings into growing their businesses.

Deductions can offer substantial benefits. However, to avoid potential pitfalls, it's crucial to remain compliant with tax laws, maintain meticulous records, and consult with tax professionals.

Staying informed and proactive helps maximize the financial advantages of tax deductions. Every dollar saved through smart tax planning is a dollar that will be reinvested into your business’s success.

FAQs

1. What is a 100 Percent Tax Deduction?

A 100 percent tax deduction allows you to deduct the full cost of an expense from your taxable income. This means that the entire amount of the expense reduces your taxable income dollar-for-dollar, effectively lowering your tax liability by the full amount of the expense.

2. What is a 1099?

A 1099 is a series of tax forms used to report various types of income other than wages, salaries, and tips. The most common form is the 1099-NEC (Non-employee Compensation), used to report income paid to independent contractors or freelancers.

3. Can You Write Off Previous Years’ Taxes?

No, you cannot deduct federal income taxes from previous years as a current business expense. However, certain taxes can be carried forward or carried back under specific circumstances. For example, State and local taxes, loss carry forward, and business property taxes.

4. What Business Has the Most Tax Write-Offs?

Certain types of businesses, especially those with substantial operating expenses, tend to have more tax write-offs. Industries with high deductions often include Real estate and property management, transportation and logistics, healthcare and medical services, construction and manufacturing, freelancers, and contractors.

5. I Rent My Home, Do I Qualify for the Home Office Deduction?

Yes, you do qualify for the home office deduction even if you rent your home, as long as you meet the requirements set by the IRS.