Saham Assurance is a renowned Moroccan insurance firm that offers a variety of insurance products and services. Here's what you should know.

Saham Assurance is a renowned Moroccan insurance firm that offers a variety of insurance products and services. Saham initially started in the insurance market and finally rose to the top of the African sector thanks to its solid entrepreneurial style.

The Group has developed into a global player with expertise in several industries after selling its insurance business in 2018. Its growth was facilitated using strategically targeted alliances in sectors like customer experience services/BPO, real estate, education, and agriculture.

Like with all businesses, the Saham Insurance portfolio is described below:

The Saham Assurance portfolio

Medjool Star

The world's most significant date palm tree farm is run by MEDJOOL STAR Saham Agri, which is also in charge of processing and marketing Medjool dates.

Education

International Education Group (IEG) works with Tana, a Temasek and Oppenheimer joint venture, to establish a global network of top universities.

Real Estate

The Group's subsidiary, Saham Immobilier, supports ground-breaking real estate developments throughout Morocco.

Customer Experience Services/BPO

A joint venture between Majorel and the Bertelsmann Group invented end-to-end customer experience services.

It operates in 31 countries and provides services to many of the most reputable digital native and vertical leading brands in the world.

What Saham Assurance Offers

Products Available

Various insurance policies are available from Saham Assurance, including those for automobiles, health, travel, property, life, and more. In addition, the firm provides for the insurance requirements of people, families, and businesses.

Customer Service

Saham Assurance has a reputation for offering first-rate customer service. Customers can contact the company's devoted customer service team anytime for assistance and queries.

Financial Stability

Saham Assurance has a significant presence in the Moroccan insurance sector and is a financially sound business. The business frequently reports profits in recent years and has a solid credit rating.

Technology

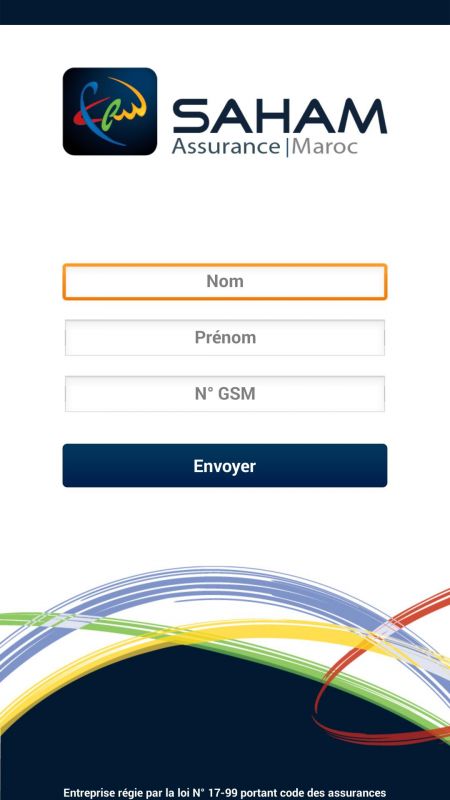

Using technology to enhance its goods and services is a priority for Saham Assurance. As a result, the organization has invested in digital platforms to improve the client experience and streamline its processes.

Reputation

The Moroccan insurance market holds high regard for Saham Assurance. The business is renowned for its dependability, openness, and integrity.

Saham Assurance is a reputable insurance provider with many insurance-related goods and services in Morocco. The organization is committed to utilizing technology to improve the consumer experience, has exceptional customer service, and is financially solid.

Reasons to choose a Saham Guarantee Package

Using a Saham Assurance program could be advantageous for several reasons:

Complete Coverage: Saham Assurance offers a variety of insurance packages that provide complete protection against various dangers. By choosing a Saham Assurance service, you are confident that you are safeguarded against unforeseen circumstances resulting in financial losses.

Saham Assurance offers policyholders the option to modify their insurance coverage to meet their needs and specifications. This implies that you can select the best deductibles, coverage tiers, and other features that suit your needs.

Financial Security:

Choosing a Saham Assurance program will give you peace of mind and financial security.

You can rely on your insurance coverage to pay the costs and avoid financial losses in the event of an unforeseen occurrence, such as a car accident, medical emergency, or property damage.

Professional Support

Saham Assurance offers a team of knowledgeable specialists who can assist you in selecting the best insurance plan and assistance should you need to file a claim. When you need help, you can count on receiving it quickly and effectively because the business has a reputation for offering top-notch customer service.

Low-cost premiums

For its insurance products, Saham Assurance offers affordable prices. Comparing different policies and picking the one that best fits your needs and budget will help you discover the coverage you need at a price you can afford.

Choosing a Saham Assurance program can offer comfort, financial security, and professional help. In addition, you may ensure you are protected against unanticipated situations that could result in financial losses by selecting the appropriate policy and tailoring it to your needs.

However, just as there are benefits to a thing, so are its shortcomings. Below are some of them

Lapses in Saham Assurance Company

An insurance provider, Saham Assurance, provides its customers with a range of insurance plans. However, while joining a Saham Assurance program may have its benefits, there are also several possible drawbacks, such as:

Cost

The price of joining a Saham Assurance program is one of its main drawbacks. Insurance policies can be pricey, and the cost may be high depending on the type of insurance and the coverage limitations you select.

Policy Restrictions

Saham Assurance policies may be subject to various limitations or conditions, such as requiring you to use particular service providers or comply with specific guidelines to be eligible for coverage. This may reduce your freedom to select your healthcare providers or facilities.

Limited Coverage

Saham Assurance insurance may provide partial coverage in some circumstances, which is another drawback. In addition, the coverage offered can be subject to exclusions or limitations based on the type of policy you select.

Claims Procedure

Some people find the Saham Assurance claims procedure time-consuming or challenging. Making a claim can be tricky since it often requires dealing with several parties, paperwork, and documents.

Possibility for Denial

There is always a chance that Saham Assurance will reject your claim, either because the policy doesn't cover the circumstance or because the insurer thinks the claim is invalid.

Saham Assurance program subscriptions frequently require a long-term commitment to premium payments, which may only be viable for some.

Ultimately, even though joining a Saham Assurance program could provide advantages like financial security and peace of mind, weighing the negatives before making a choice is vital.

Well, there's a chance you can enjoy more of the benefits than the lapses and get your insurance right on check. Good luck with that!