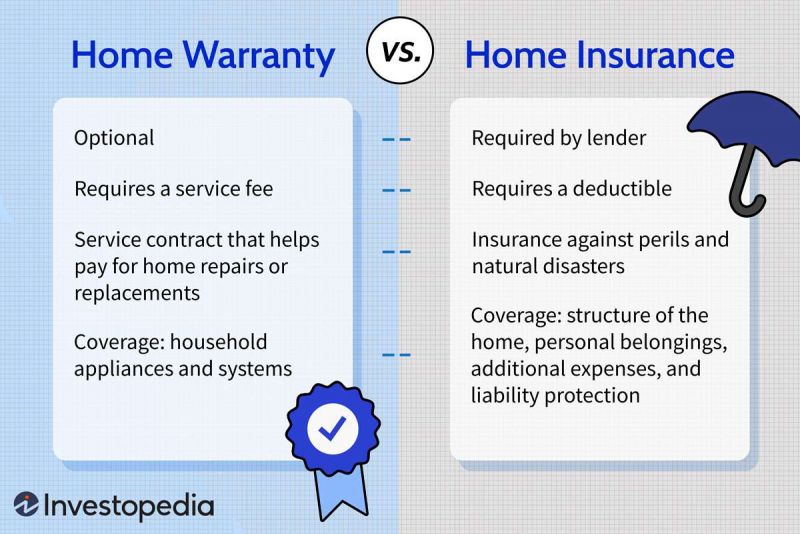

Before deciding which to go for between Home Warranty and Home Insurance, it is best to have a good understanding and know the differences between them

HOME WARRANTY VS HOME INSURANCE

Before deciding which to go for between Home Warranty and Home Insurance, it is best to have a good understanding and know the differences between them.

Let's go through a detailed explanation of both.

Home Warranty

A home warranty is simply a contract or deal for a specific period of time. It covers the cost of maintaining household appliances or systems.

A home warranty is advised when purchasing an old home for which information is not available on the items. Home warranty companies work with one or more home service providers like plumbing or electrical contractors.

The homeowner contacts the warranty company when a system or appliance is damaged. The company, after being notified of a claim, requests services from one of its partnered providers, who will, in turn, access the damage and provide a report to the warrantor.

The company assesses the report that reveals the cause and extent of damage to the appliance. After which, the company confirms if the policyholder's contract covers the damage to the assessed system or appliance.

If approved, the warrantor commissions the contractor to replace or repair the system. When purchasing a home, how well the previous owners managed and maintained the components of the home may not be known by the buyer.

Age information, as well as appliances' useful life, may not also be available to the buyer at the time of purchase. This is why getting a home warranty is recommended.

A home warranty plan, also known as a residential service contract, covers major appliances such as stoves, refrigerators and water heaters. It equally covers systems such as plumbing, HVAC and electrical.

Home Insurance

Home insurance covers cost and damage to your home, its content and possessions. It covers the cost of damages due to an unfortunate event.

Although it covers damage for both man-made and natural causes, it doesn't cover damage for some few accidents like damage due to neglect, 'Acts of God', war situations and intentional damages.

You need documents or evidence of damage to be able to claim home insurance money. There may be depreciation calculations depending on the insured item and the insurance provider.

Having a home insurance policy is good because it helps to guard property against unpredictable damage and associated costs.

A home insurance policy covers the following events on the insured property :

- Exterior damage

- Interior Damage

- Damage or loss of personal belongings or assets

- An injury that happens while on the property

While a home warranty maintains the functionality of household systems which can either break or wear out, Home insurance covers loss or damage to the home itself. This damage can be due to natural disasters or fire.