The SEC said late on Wednesday that it had charged both Wang and Ellison with misleading FTX investors.

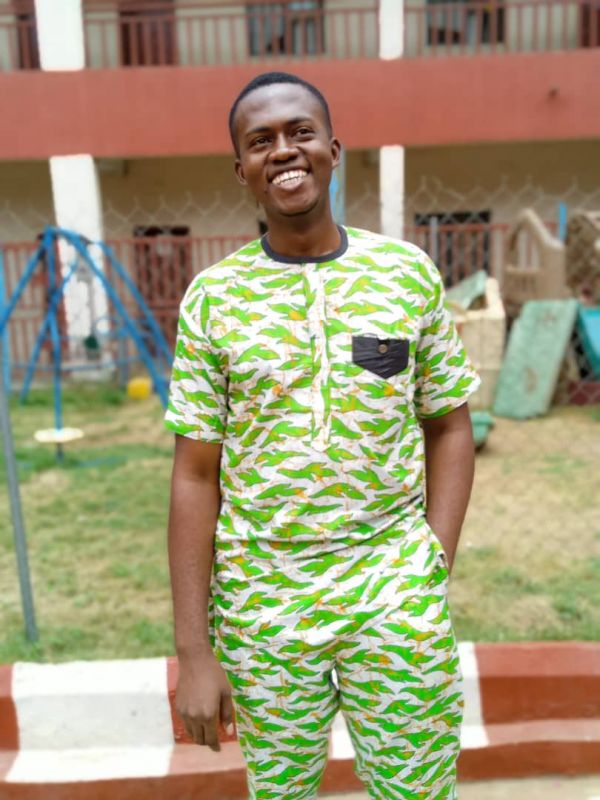

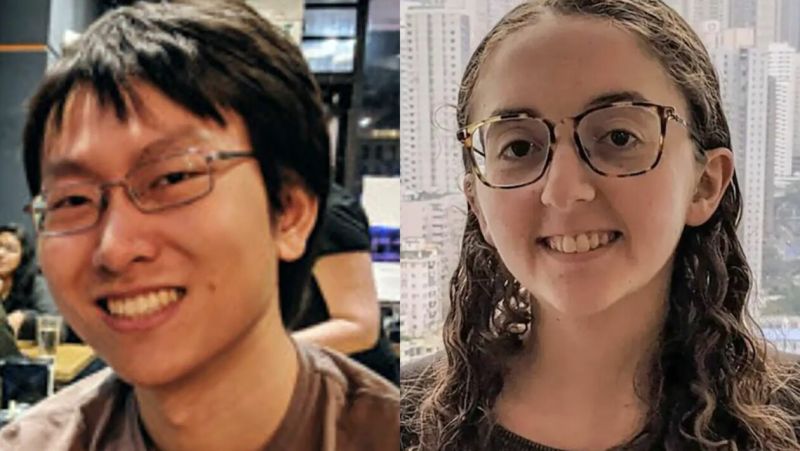

Gary Wang, a co-founder of FTX and a former CTO, and Caroline Ellison, a former CEO of Alameda Research, have admitted guilt to charges relating to their roles in fraud that caused FTX to fail, according to U.S. Attorney Damian Williams on Wednesday night.

Williams stated that Wang and Ellison are helping with the Justice Department's probe. However, Williams omitted to include the counts that Wang and Ellison were accused of and the offences for which they both admitted guilt.

Gary Wang and Caroline Ellison, ex-executives of FTX and Alameda, have admitted guilt to DOJ allegations

The SEC said late on Wednesday that it had charged both Wang and Ellison with misleading FTX investors. However, the SEC noted that both were working on their investigation and had reached agreements with the SEC.

The 28-year-old Caroline Ellison oversaw FTX's subsidiary Alameda Research, a crypto hedge fund. Sam Bankman-Fried, a former CEO of FTX, and Ellison previously collaborated at Jane Street.

Bankman-Fried shared a residence with Gary Wang, 29, during their time as undergraduates at the Massachusetts Institute of Technology. In 2019, Wang and Bankman-Fried co-founded FTX.

After receiving approval from the Bahamas Minister of Foreign Affairs, a judge on Wednesday authorized Bankman-extradition Fried's to the United States. Williams also verified Sam Bankman-extradition Fried and transferred to American custody.

Samuel Bankman-Fried is currently being held by the FBI and is returning to the country. However, according to Williams, he will be flown directly to the Southern District of New York, where he will appear in court as soon as feasible.

The Bahamas Royal Police detained Bankman-Fried on December 12 night. Bankman-Fried was detained at the Fox Hill prison in New Providence, Bahamas, until Wednesday.

A Bankman-Fried representative declined to comment. However, Williams stated last week that this probe is still progressing swiftly. "I also said that the announcement we made last week wouldn't be our last. And once more, let me be clear: Neither is today.

Williams urged anyone who had engaged in improper behavior at FTX or Alameda to come forward. But, he answered, "Our patience is not endless. Yahoo Finance contacted the U.S. Attorney's Office, Southern District of New York, but received no response.

Read Also: Sam Bankman-Fried, An Ex-CEO Of FTX, Is Accused Of Scamming Investors

An SEC complaint

The SEC's lawsuit claims that between 2019 and 2022, Ellison advanced a conspiracy to manipulate the price of FTX's token, FTT, "by acquiring significant quantities on the open market to increase its price" under Bankman-supervision.

By doing this, FTX could use FTT as security for loans to Alameda that FTX had taken out using its clients' assets. According to the SEC complaint, the outcome allowed Alameda's balance sheet value to be exaggerated, deceiving investors about FTX's risk.

By publication, the SEC had not responded to Yahoo Finance's request for comment. Instead, bank man-Fried promoted FTX simultaneously as a “secure crypto asset trading platform with cutting-edge risk mitigation mechanisms to protect customer assets.”

John J. Ray III, the current CEO of FTX, asserted that the company had lost more than $7 billion. He said this during his testimony on December 13 before the U.S. House Financial Services Committee.

According to the SEC complaint, monies from FTX customers were used to finance personal real estate acquisitions, loans to FTX management, and Alameda's trading activity.

The complaint said that between March 2020 and September 2022, Bankman-Fried "executed promissory notes for loans from Alameda totaling more than $1.338 billion."

"In two cases, Bankman-Fried was both the borrower in his capacity and the lender in his capacity as CEO of Alameda." “Ellison knew about these 'loans,' or he was careless in his ignorance.”

The platform's software technology that permitted Alameda to drain FTX customer funds, according to the SEC, was written by Wang while serving as FTX's CTO. According to the SEC's lawsuit, Ellison used the diverted money at Alameda for trading activities.

The complaint claims that Bankman-Fried, with the knowledge of Ellison and Wang, "sent hundreds of millions of dollars more in FTX customer monies to Alameda" even after it became evident that FTX could not make its customers whole.

According to the SEC's announcement in its case, “Defendants concealed the genuine risks that FTX's investors and consumers faced by covertly siphoning FTX's customer monies onto the books of Alameda.”

The SEC wants Ellison and Wang to pay fines and be prevented from serving as corporate officials or directors. Additionally, an injunction is requested to prevent the defendants from directly or indirectly participating in the creation of traditional securities and cryptocurrency securities.

According to the SEC, both parties have achieved settlements subject to court approval.