Moody's Investors Service cuts Egypt's credit rating down from B2 to B3 due to the decrease in Egypt's external buffers and shock absorption ability.

As Egypt pursues economic reforms and structural improvements following its International Monetary Fund program, its external buffers and shock absorption ability have decreased, prompting Moody's Investors Service to cut Egypt's credit rating from B2 to B3.

According to a statement from Moody's, the country's outlook was upgraded from negative to stable.

The rating agency noted that "liquid foreign currency (FX) reserves have fallen since the damaging outlook assignment in May 2022.

It also states that FX liquidity buffers in the monetary system have shrunk (as indicated by the accumulation of substantial net foreign liability holdings at the central bank and commercial banks), raising external vulnerability at a time of precarious global conditions.

Moreover, as the North African nation transitions to a more export- and private-sector-led growth model under a flexible currency rate framework, the rating fall pushes Egypt farther into junk territory.

Egypt and the IMF agreed on a $3 billion rescue package last year. Still, it is conditional on Egypt implementing a flexible foreign exchange system and shrinking the role of the government in the economy to make place for the private sector.

As part of the nation's new IMF program, the Egyptian government will begin selling state-owned assets this month.

According to Moody, this will enhance the nation's structural adjustment and generate dependable non-debt-creating capital inflows to cover rising external debt service obligations over the following two years.

Prime Minister Mostafa Madbouly announced last week that Egypt intends to float at least 20 state-owned companies on the stock market this year.

The government wants to draw in international investors and boost the economy.

In varied degrees, the enterprises will be privatized, according to Mr. Madbouly.

These steps will take some time to lessen Egypt's external vulnerability threats. The government's ability to control the implications for inflation and social stability is still to be established, the rating agency added, despite its apparent commitment to a completely flexible currency rate.

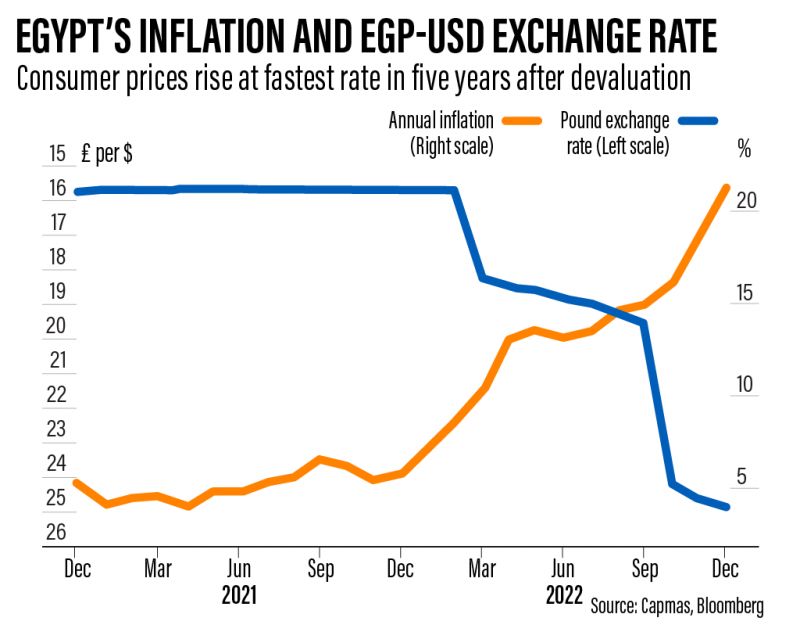

The third-largest economy in the Arab world had soaring inflation last year, which was made worse by the effects of the war in Ukraine. As a result, the Central Bank of Egypt decided to hike interest rates by 800 basis points in 2022.

However, in response to the US Federal Reserve hiking rates to their highest level since 2008, the central bank kept its rates unchanged at its meeting last week.

After some nations joined a boycott of Russian oil exports last year, the government was forced to acquire crude oil and processed fuel amid a jump in costs brought on by the conflict in Ukraine.

As a result, wheat and other staple commodities saw a significant price increase when the war reduced Ukrainian shipments through the Black Sea.

Goldman Sachs anticipates headline inflation in the nation to peak in February before gradually falling to roughly 16% by the end of 2023 and below 9% by the end of next year.

This follows a series of devaluations of the Egyptian pound in 2022 and early January of this year. Over the past year, Egypt has allowed its currency to decline by almost 50%; the official exchange rate for the pound is currently 30 to the dollar.

According to Goldman Sachs, the CBE will likely continue to tighten monetary policy in the first quarter of this year due to the current high inflationary pressures and the need to quicken the pace of disinflation.

Goldman Sachs predicts that Egypt's inflation rate will reach a record high of 23.8% in January after reaching a record high of 21.3% in December.

According to the median estimate of the 14 analysts surveyed by Reuters, annual inflation was 23.75 percent in January.

Despite historical inflation, Egypt's central bank maintains rates

The rate of inflation in Egypt is at its highest point in five years. According to Moody's latest downgrade report, the government faces downside risks due to increased domestic borrowing costs, social spending pressures in an inflationary climate, and liquidity risks within constrained foreign capital market conditions.

This risk is "mitigated by the government's committed domestic financing base and the government's track record of consistently generating primary surpluses, which [it] thinks will assist lower the debt load after a short setback," according to Moody's.

In the meantime, the rating agency stated that upside risks are related to the implementation of government reforms that may increase the export base of the economy and support inflows of foreign direct investment, which "would enhance the economy's external debt carrying capacity and sustainably reduce the economy's external vulnerability risks."

According to Moody's, Egypt's liquid foreign currency reserves fell to $26.7 billion at the end of December 2022 from $29.3 billion at the end of April 2022, while the monetary system's net foreign liabilities position climbed to $20 billion at the end of December from $13 billion in April.