Planning to buy property, run a business, or work in California? Explore the best tax-saving tips for 2024 to maximize your savings and reduce taxable income

California's tax system is one of the most difficult and expensive in the United States, impacting nearly every aspect of financial life for residents.

The state imposes high-income tax rates, ranging from 1% to 13.3%, depending on your earnings. Hence, Californians must take full advantage of deductions, credits, and tax-saving opportunities, which makes tax saving important.

This guide will explore the top tax-saving strategies designed specifically for Californians. It will help you take advantage of opportunities such as health savings accounts (HSAs), 529 college savings plans, and self-employment deductions among others to minimize your tax liability.

Summary

- California has one of the most challenging tax systems in the U.S., with high income, sales, and property taxes.

- Effective tax planning helps minimize liabilities through deductions and credits for retirement accounts, child tax credits, and self-employment expenses.

- Timing major expenses and using Health Savings Accounts (HSAs) and 529 College Savings Plans can offer significant tax relief.

- Leveraging these strategies, Californians can better manage the state's complex tax system and reduce their tax burden.

California’s Tax System

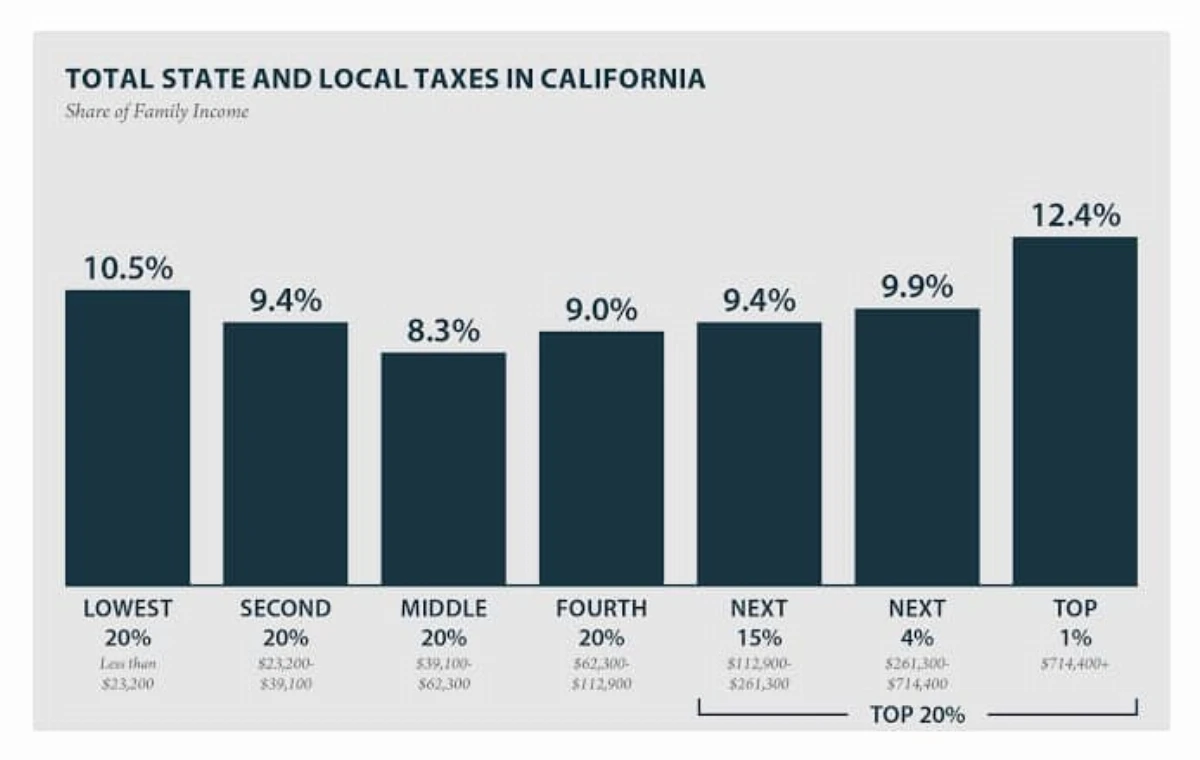

California has long been recognized for having one of the highest tax burdens in the United States. The state’s tax system includes a progressive personal income tax with rates that are among the highest in the nation, coupled with a significant corporate income tax and statewide sales tax.

These tax rates are intended to support a wide range of public services, including education, infrastructure, and social programs. However, the tax system has also been a point of contention for residents and businesses, particularly due to its perceived impact on economic growth and competitiveness.

Over the years, businesses in California have expressed concerns about the state's tax structure, which they argue makes it difficult to operate profitably, especially for those in low-margin industries.

Despite these concerns, California continues to implement and consider new tax initiatives aimed at funding expansive social and public programs.

The ACA 11 Proposal and Its Implications

One of the most recent tax initiatives is the ACA 11 proposal, which aims to fund a state-run single-payer healthcare system. If passed, ACA 11 could impose a range of new taxes that would significantly affect businesses and individuals in the state.

Key elements of the proposal include:

- 2.3% Gross Receipts Tax: This tax would apply to the total revenues of businesses, regardless of their profitability. For low-margin businesses, this could be especially burdensome, potentially pushing them into financial difficulty.

- 1.25% Payroll Tax: Employers with 50 or more employees would face a new payroll tax, with higher rates for wages paid to employees earning over $49,900 annually. This could lead to reduced hiring or wage growth, particularly in industries that rely heavily on middle-income workers.

- Personal Income Tax Increases: Under ACA 11, personal income tax rates would increase by 0.5% to 2.5%, depending on income. While aimed at higher earners, this would add to California's already high tax rates and may further motivate some individuals to leave the state.

Best Tax Saving Tips for California in 2024

Maximize Retirement Savings

One of the most effective ways to reduce your tax burden in California is by maximizing contributions to tax-deferred retirement accounts like 401(k)s and Traditional IRAs.

These contributions are deducted from your taxable income, lowering your overall tax liability. For 2024, the contribution limit for 401(k) plans is $22,500, and for Traditional IRAs, it is $6,500.

Additionally, a Roth IRA can offer valuable benefits for Californians, particularly given the state's high-income tax rates. With a Roth IRA, you avoid paying taxes on withdrawals during retirement when you might be in a higher tax bracket.

Leverage Standard and Itemized Deductions

The standard deduction in 2024 automatically reduces your taxable income without needing detailed documentation. However, in some cases, itemizing deductions may offer more tax savings.

For instance, if you own a home, have high medical expenses, or make significant charitable contributions, itemizing could be beneficial. For example, paying $15,000 in mortgage interest and $5,000 in property taxes gives you $20,000 in itemized deductions—more than the standard deduction.

Common itemized deductions include mortgage interest, property taxes, and charitable donations, which can provide tax relief while supporting your community.

Manage IRA and Retirement Distributions

Understanding the tax implications of IRA distributions is crucial for effective financial planning. For example, withdrawing $10,000 from an IRA at age 55 may incur a $1,000 penalty.

Additionally, at age 72, you are required to take Required Minimum Distributions (RMDs) from Traditional IRAs or 401(k)s, which are based on your life expectancy and account balance. Failing to take RMDs results in steep penalties.

To reduce the tax impact, you can delay RMDs if you are still working, or convert part of your Traditional IRA to a Roth IRA, which has no RMD requirements.

Claim the Child Tax Credit and Dependent Care Benefits

California offers a Child Tax Credit of up to $1,000 per qualifying child under 17. For single filers with a modified adjusted gross income (MAGI) of up to $30,000 and married couples with a MAGI of up to $60,000, this credit can directly reduce your tax bill.

Additionally, the Child and Dependent Care Expenses Credit helps offset childcare costs like daycare or after-school programs. You may claim up to 50% of qualifying expenses, with a maximum of $3,000 for one child and $6,000 for two or more children.

Utilize Self-Employment Tax Deductions

Self-employed Californians can take advantage of several tax deductions, such as the home office deduction. If you use part of your home exclusively for business, you can deduct a portion of expenses like rent and utilities.

If you run a business from a dedicated office in your home, you can deduct the percentage of home expenses based on the office’s square footage.

The self-employment tax deduction also allows you to deduct half of your Social Security and Medicare taxes from your taxable income. For example, if your net earnings are $60,000, you can deduct half of the self-employment tax, reducing your taxable income by around $4,590.

Plan for Tax Residency and Relocation

California’s high income and property taxes mean that your residency status affects your tax liability. As a resident, you're taxed on all income, regardless of where it’s earned.

However, part-time residents or those relocating to states with lower or no income tax, like Nevada or Texas, can reduce their California tax burden.

If you move mid-year, California only taxes income earned while you were a resident. For instance, moving to Nevada in June would mean you owe taxes on income earned from January to June. Timing your move strategically can minimize your California taxes.

Open a Health Savings Account (HSA)

Contributing to an HSA provides tax advantages for those enrolled in high-deductible health plans (HDHPs). Contributions reduce your taxable income, and withdrawals for qualified medical expenses are tax-free. For example, if you contribute $4,150 in 2024 as an individual, that amount lowers your taxable income.

HSAs also cover qualified medical expenses, allowing tax-free withdrawals for doctor visits, prescriptions, and dental care. For instance, if you incur $1,000 in medical bills, you can withdraw from your HSA without paying taxes.

Contribute to a 529 College Savings Plan

Although California does not offer a state tax deduction for 529 College Savings Plan contributions, the federal tax advantages are significant. Contributions grow tax-free, and withdrawals for qualified education expenses are exempt from federal income tax.

For example, if you contribute $5,000 annually over 10 years and your investment grows to $75,000, you won’t owe taxes on the earnings when used for college expenses. Additionally, up to $10,000 annually can be used for K-12 tuition at private schools.

Time Major Expenses and Income

Timing major expenses and income can reduce your tax liability. For example, if you expect to sell an investment property and incur capital gains, making large charitable donations or home repairs in the same year can reduce your taxable income through itemized deductions.

Additionally, deferring income can lower your current tax liability. For example, if you're close to a higher tax bracket, you can negotiate with your employer to delay a year-end bonus or, if self-employed, delay invoicing clients until the next year.

Claim Disaster Loss Deductions

Californians affected by natural disasters can claim disaster loss deductions. For example, if your home is damaged by a wildfire and you incur $50,000 in repair costs not covered by insurance, you can deduct the unreimbursed amount from your taxable income.

To claim these deductions, you must itemize and file IRS Form 4684. The loss must exceed 10% of your adjusted gross income (AGI) after subtracting $100 per event.

Write Off Business Trips and Travel

Business owners and the self-employed can deduct travel expenses related to their work, such as airfare, lodging, and meals (up to 50%). For example, if you travel to a conference in San Francisco, you can deduct these expenses as long as the trip is necessary for your business.

Keep detailed records, including receipts, itineraries, and notes about the business purpose of each trip, to ensure these deductions are valid.

Donate Stock to Avoid Capital Gains Tax

Donating appreciated stock to charity instead of selling it can help you avoid capital gains tax. For example, if you bought stock for $5,000 and it’s now worth $10,000, donating it allows you to deduct the full $10,000 without paying capital gains tax on the $5,000 increase.

This is especially beneficial for high-income earners in California, where combined federal and state capital gains tax rates can reach up to 37.1%.

Save for Retirement with an IRA or 401(k)

Contributing to a traditional IRA or 401(k) reduces your taxable income since contributions are made with pre-tax dollars. For instance, if you earn $80,000 and contribute $10,000 to a 401(k), your taxable income is reduced to $70,000.

With a Roth IRA or Roth 401(k), contributions are made with after-tax dollars, meaning withdrawals during retirement are tax-free.

Optimize Use of Flexible Spending Accounts (FSAs)

FSAs allow employees to set aside pre-tax dollars for eligible medical expenses. However, FSAs are "use-it-or-lose-it," meaning unused funds may be forfeited at the end of the year.

To maximize tax benefits, carefully plan your FSA contributions and time your medical expenses. For instance, if you have a vision exam and purchase glasses in the same year, you can use your FSA to cover both expenses.

Conclusion

Tax planning in California is essential for compliance and ensuring that you take full advantage of available opportunities to maximize your savings. Key strategies include maximizing contributions to retirement accounts and leveraging deductions such as those for business expenses or medical costs.

Regularly reviewing your financial situation, staying informed about tax law changes, and consulting with tax professionals can help you adapt your strategies as needed, allowing you to keep more of your hard-earned money while navigating California’s tax system effectively.

FAQs

Why do I owe so much in California state taxes?

You owe so much as a result of a progressive income tax structure, high property values, and capital gains from investments, which all contribute to your taxable income.

What is the deadline for California state tax?

The deadline for filing California state taxes is typically April 15 each year, aligning with the federal tax deadline, unless it falls on a weekend or holiday, in which case it may be extended.

Are pensions or retirement income taxed in California?

Yes, California taxes pensions and retirement income, including distributions from 401(k) plans and IRAs, though Social Security benefits are exempt from state income tax.

Does California tax Social Security benefits?

No, California does not tax Social Security benefits, allowing recipients to keep more of their income from this federal program.

How is property taxed in California?

Property in California is taxed based on its assessed value, with a general property tax rate of 1% of the assessed value, plus any additional local taxes and assessments.

Will my heirs have to pay inheritance and estate tax in California?

California does not impose an inheritance tax, and while there is no state estate tax, federal estate taxes may apply to estates exceeding certain thresholds.

Are there tax breaks for older California residents?

Yes, older California residents may qualify for various tax breaks, including property tax exemptions and credits, as well as certain income exclusions for retirement income.

Are military benefits taxed in California?

Military benefits, such as active duty pay and certain retirement benefits, are generally not taxed by California, though federal taxes may still apply.